The Impact of Deposit Volatility and Banking Stress on Reserve Balances

August 8, 2023 | ModernFi Insights

Unlike Call Report data, the oft-overlooked Senior Financial Officer Survey conducted by the Fed provides an informative glimpse into the strategic planning of a wide range of banks. The most recent Survey results were published last week, and they highlight how institutions are positioning their balance sheets in the aftermath of the banking turmoil. The most interesting results are around banks’ lowest comfortable level of reserves (LCLOR), the lowest level of reserves that each institution would feel comfortable holding before taking action to increase liquidity.

Since November 2022, roughly 40% of institutions have increased their LCLOR in direct response to the banking-sector stress and volatility. Almost all banks reported an increase in their LCLOR since 2020, with the majority reporting a significant increase of 20 percent or more. The most important factors cited for the increase include 1) satisfying liquidity-testing metrics, 2) meeting projected liquidity outflows over a certain window, 3) meeting intraday payment or settlement needs, and 4) the amount of less-stable deposits as a portion of total liabilities.

In simple terms, banks are holding additional cash balances in light of the banking stress and are planning to continue doing so. What’s interesting here is deposit runoff assumptions have likely changed. Liquidity testing is already taking into account larger potential run scenarios under stress, and deposits in general are considered less stable and less sticky. The rollout of FedNow will only increase the amount of cash held on book for payment and settlement.

We’ve talked about it before, but the continued rise of financial technology is changing deposit speed and stickiness, and institutions are reacting by holding more cash. In addition to higher reserves, better deposit monitoring and analytics, efficient access to wholesale funding options, and the increased use of deposit products focused on stickiness, like reciprocal accounts, will all play a role in helping institutions navigate this new era.

Best,

Paolo and the ModernFi Team

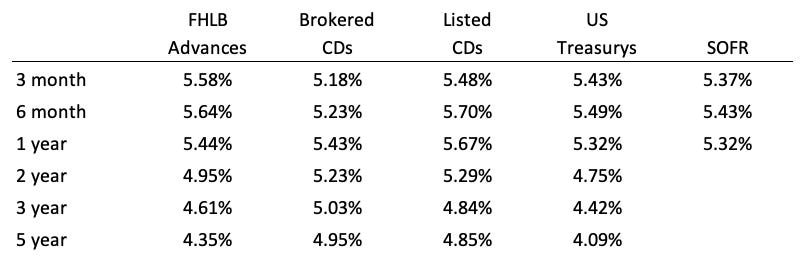

Current rates

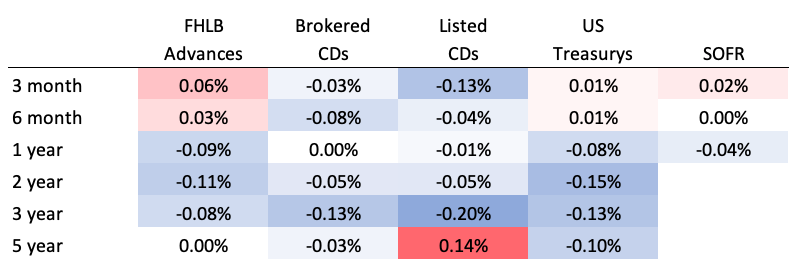

Change from two week ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys provided by WSJ. SOFR provided by CME. Change in the 5 year Brokered CD rate reflects change from four weeks ago due to missing values.