We have spoken at length on how introducing modern technology and infrastructure can significantly improve the way banks can operate and offer services to their clients. This new technology and heightened level of efficiency offered to bank clients could, however, potentially pose a risk to banks if the institution’s internal tools rely on legacy systems and processes. When examining a bank’s tech stack holistically, there tends to be a stark mismatch in usability between the “frontend” and the “backend” of a bank.

In recent years, we have observed a vast improvement in the “frontend” technology of banks. This includes digital and mobile banking, digital account opening, money movement rails, and the various services offered by neobanks and banking-as-a-service providers. With these products and services, bank clients are able to execute with speed – withdrawing and depositing funds instantly through their phone or quickly opening new accounts. SVB provided a prime example of how digital banking can enable speed; nearly $42 billion was withdrawn in a single day resulting in the quickest bank run in US history.

While the “frontend” of many banks is in the modern era, the “backend” of banks is often built on legacy systems and processes, especially for deposit and balance sheet management. As bank clients quickly move deposits in and out their accounts, asset-liability management teams and bank operators are often forced to rely on spreadsheets, phone calls, emails, and interfacing with UIs built in the 90’s (recall Citi accidentally sending Revlon $900M because of poor UI) to manage their balance sheet. This mismatch in technology ultimately poses a risk to banks.

Recent events have reinforced the need for better “backend” tools for banks so ALCOs can manage their balance sheet in real time at the new speed of deposits. Among many things, this includes analytics on intraday deposit flows, deposit composition, accounts at risk, volatile deposits, and potential liquidity gaps. In the coming weeks, we will speak more deeply on how ModernFi is working to bring better technology to the “backend” of a bank.

Best,

Adam and the ModernFi Team

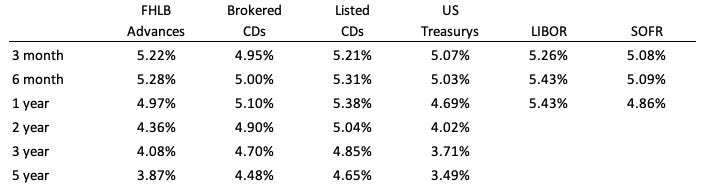

Current rates

Change from one week ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.

Disclosures:

All information contained herein is for informational purposes and should not be construed as investment advice. It does not constitute an offer, solicitation or recommendation to purchase any security, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Past performance does not guarantee future results. The information contained herein is for institutional use only.

ModernFi Advisers LLC (ModernFi) is not a bank, nor does it offer bank deposits and its services are not guaranteed or insured by the FDIC; ModernFi allocates funds to banks that are FDIC members. ModernFi is an investment adviser registered with the United States Securities and Exchange Commission (SEC). For more information regarding the firm, please see its Form ADV on file with the SEC through the Investment Adviser Public Disclosure website. Registration with the SEC does not imply a particular level of skill or training.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by ModernFi. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by ModernFi or any other person. While such sources are believed to be reliable, ModernFi does not assume any responsibility for the accuracy or completeness of such information. ModernFi does not undertake any obligation to update the information contained herein as of any future date.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Except where otherwise indicated, the information contained in this communication is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision.