Substack requires an icon image, so I’ll start including one here. I also think last update’s image was incredible.

We’ve talked about the liquidity crunch across the banking sector in recent weeks. However, quite a few institutions still find themselves on the flip side of the coin – sitting on too many deposits. Is this a serious problem though? Well, an excess of deposits can negatively impact the health of a bank’s balance sheet. Specifically, an excess can breach regulatory constraints and harm both health and performance metrics.

On the regulatory front, bank growth is limited by capital requirements, which track bank equity capital as a percentage of assets. When deposits grow rapidly, a bank’s capital ratio falls as assets increase yet equity remains constant. To stay compliant with regulation, banks must either shed deposits or raise more capital.

Banks also face regulatory thresholds that are based on asset size. Many fintech banks are incentivized to stay under $10 billion in assets to remain Durbin-exempt and earn healthy interchange revenue from their card programs. Others want to remain under $1 billion in assets to skip additional FDIC reporting requirements, or under $50 billion to avoid the “large and highly complex” designation. Crossing these thresholds often increases the regulatory burden for banks and changes their unit economics.

An excess of deposits can also harm a bank’s health and performance metrics across the board. Excess deposits, by definition, mean the bank does not have enough loan demand to deploy the funds, and the funds remain on book as lower-yielding cash or securities. Excess deposits negatively impact all asset-dependent ratios, including return on assets, equity to assets, and net interest margin.

So having too many deposits can truly cause issues – banks start to worry about breaching their capital requirements or other regulatory thresholds, and they are faced with falling return on assets, equity to assets, and net interest margin. Interestingly, banks with excess deposits don’t have that many great options. Next time around, we’ll discuss some of the approaches banks take to manage deposit levels.

Best,

Paolo and the ModernFi Team

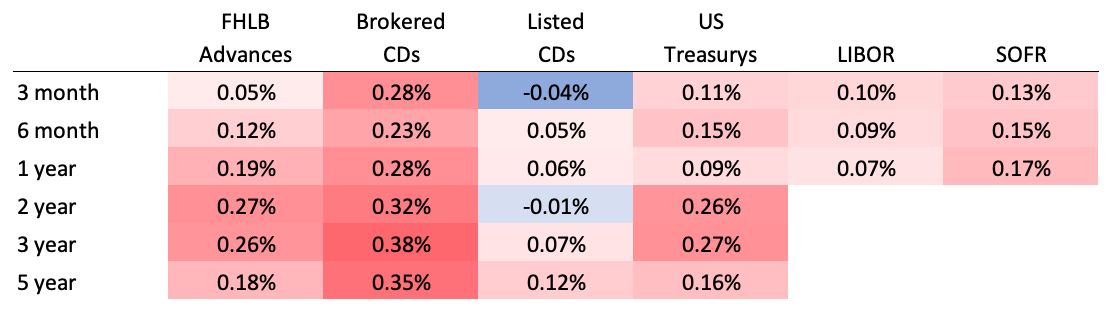

Current rates

Change from two weeks ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.