We’ve written at length about the large amount of deposits that have runoff from the banking sector over the previous quarters. As interest rates have risen, depositors have pulled funds from banks and reinvested in higher-yielding asset classes. The yields on other assets such as Treasurys, municipal bonds, and commercial paper tend to rise more quickly than the yields on bank accounts. Money market funds (MMFs), which provide investors with an easy way to invest in the aforementioned assets, have seen huge inflows in recent months [1].

Assets in money market funds have reached record levels. The funds held $5.18 trillion at the end of December 2022, and an additional $135 billion flowed into the funds in January alone [2]. The yield differential compared to bank accounts is stark, with U.S. funds yielding above 4% on average while the average savings account yields 0.35% [3].

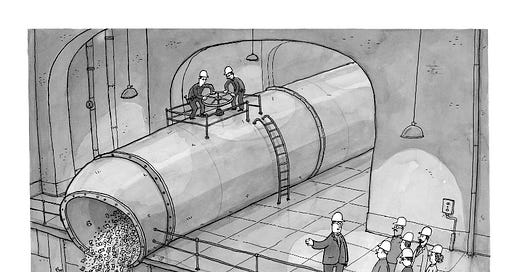

Importantly, the runoff to money funds disproportionately affects smaller banks. Large, complex institutions are active in a variety of funding markets and issue commercial paper, which is then purchased by money funds, returning some of the runoff right back to the institutions. Smaller institutions, including most community banks, don’t have access to and don’t participate in these markets. They don’t issue paper and don’t receive any investment from money funds.

The asymmetric return of deposit runoff across the banking sector highlights the need for more accessible, transparent, and efficient funding markets open to all banks [4].

Best,

Paolo and the ModernFi Team

Notes and Sources

Credit for this asymmetric return idea goes to our academic friends at Harvard

[1] As a historical tangent, MMFs were created because investors needed a place to hold short-term cash, and regulation (Reg Q from the Fed) prohibited demand deposit accounts from paying interest and limited the amount of interest that banks could pay on other account types. If the regulation had been different, MMFs may never have caught on, and these deposits might still be at banks today…

[2] Data on asset totals from EPFR and data on flows from Crane (both behind paywall)

[3] Data on MMF yields from Crane and bank account yields from FDIC

[4] We’re obviously a little biased over here at ModernFi

Current rates

Change from two weeks ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.