Financial crises normally lead to new financial regulation. Following the failures of SVB, Signature, and Silvergate, regulators and policymakers have leapt into action and launched reviews, audits, examinations, and recriminations. On March 28th, Martin Gruenberg, Chairman of the FDIC, made a statement in front of the Senate Banking Committee that provided an invaluable glimpse into the Corporation’s thinking and future plans.

In his remarks, Chairman Gruenberg described the preliminary lessons learned from the bank failures. In regulator speak, “lessons learned = things we want to fix”. Gruenberg focused on three points: the banks 1) were heavily reliant on uninsured deposits, 2) accumulated losses in their securities portfolios, and 3) were over $100bn in assets. Unsurprisingly, this means there will likely be 1) increased restrictions / scrutiny on uninsured deposit exposure, 2) increased scrutiny on unrealized losses, and 3) new regulatory requirements for banks over $100bn in assets.

It is interesting that the number 1, primary, most important lesson learned is related to deposits. Not a lack of interest rate risk management, nor poor asset allocation or poor overall ALM, but use of uninsured deposits. As a result, the FDIC is putting together “policy options for consideration related to deposit insurance coverage levels, excess deposit insurance, and the implications for risk based pricing and deposit insurance fund adequacy.”

Deposit insurance coverage levels, which were raised from $100,000 to $250,000 per depositor in 2008 during the Global Financial Crisis, have been a contentious topic for years now. Some institutions are heavily in favor of raising the cap as it would help them attract and retain larger value clients. Others are strongly opposed as any increase would no doubt increase FDIC assessment fees paid by banks. Given regulator statements, there is a real possibility that coverage levels will be increased.

Blanket deposit insurance coverage, which was provided to depositors of SVB post-collapse and also to certain accounts during the Global Financial Crisis, is highly unlikely. Regulators are worried about the moral hazard created by blanket insurance, where a bank might take more risk than it would otherwise if it knew that all deposits were insured. In addition, the deposit insurance fund, which currently holds just $128bn as of Q4 2022, is not adequate to cover all deposits, both insured and uninsured.

It is notable that Gruenberg also highlighted “excess deposit insurance”. Presumably, this means deposit sweep programs and reciprocal products that provide extended FDIC insurance to depositors by allocating deposits to a network of banks. These products have proven instrumental to community and regional banks over the past few weeks (and decades) as they have helped smaller institutions retain depositors that might have otherwise fled to the “too big to fail” banks. It is likely, however, that the FDIC will revaluate the the size of the insurance fund and assessment fees if sweep products increase the total amount of insured deposits in the system.

Just like people used to analyze the size of Fed Chairman Alan Greenspan’s briefcase before Fed meetings, we’re now analyzing Gruenberg’s adjectives in his speeches. We’ll know more on May 1 when the FDIC releases its initial report, but given Gruenberg’s comments, we do expect changes to deposit insurance.

Best,

Paolo and the ModernFi Team

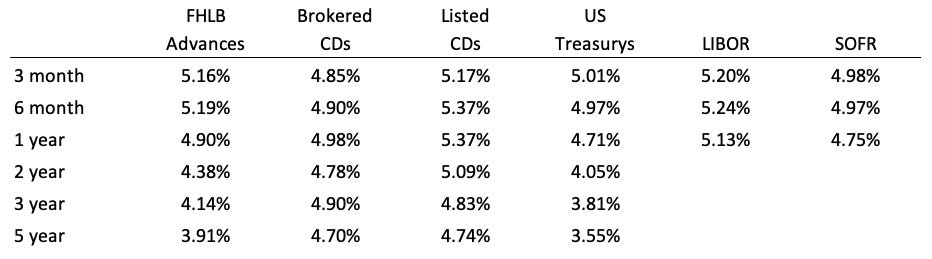

Current rates

Change from one week ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.