The rapid failures of three banks – representing the second, third, and fourth largest bank failures in U.S. history – have left depositors on edge. Some large depositors worried about potential risk to uninsured deposits have moved their funds to large institutions or out of the banking system entirely, accelerating an already worrisome trend of deposit outflows.

Reciprocal products, where banks exchange deposits to provide depositors with extended insurance, offer a powerful solution. Depositors using a reciprocal product can benefit from the extended FDIC insurance provided by diversifying their deposits across multiple banks. Importantly, much of the complexity is handled behind the scenes, and the depositor only needs to maintain a single relationship with their home institution.

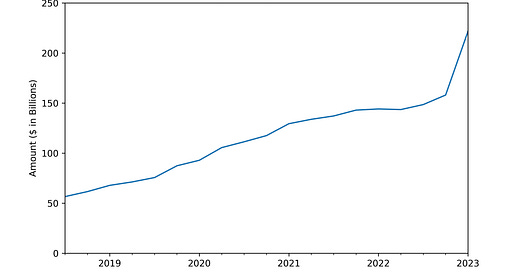

The use of reciprocal deposits shot up in Q1 2023, growing 40% quarter over quarter from $158bn to $222bn. Reciprocal deposits have grown steadily 35% year over year since they were first reported on call reports in 2018, but the recent focus on insurance has supercharged their use.

We expect the use of reciprocal deposits to continue to grow quickly over the next few quarters. However, there is a huge gap between the $5.1 trillion of uninsured deposits outside of the largest four banks and the $0.2 trillion of reciprocal deposits, suggesting the products are significantly underused by depositors and banks. Current reciprocal products tend to be operationally painful for both the depositor and the bank, limiting their adoption. We believe that reciprocal products can play a significant role in helping banks across the country, but only if they become seamless enough to be the default account for large-value depositors.

Best,

Paolo and the ModernFi Team

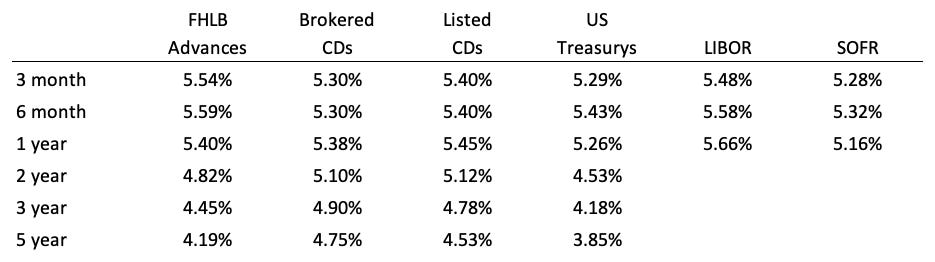

Current rates

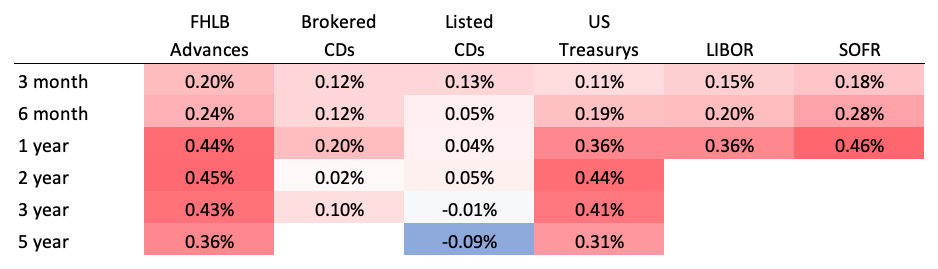

Change from two week ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.

Disclosures:

All information contained herein is for informational purposes and should not be construed as investment advice. It does not constitute an offer, solicitation or recommendation to purchase any security, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Past performance does not guarantee future results. The information contained herein is for institutional use only.

ModernFi Advisers LLC (ModernFi) is not a bank, nor does it offer bank deposits and its services are not guaranteed or insured by the FDIC; ModernFi allocates funds to banks that are FDIC members.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by ModernFi. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by ModernFi or any other person. While such sources are believed to be reliable, ModernFi does not assume any responsibility for the accuracy or completeness of such information. ModernFi does not undertake any obligation to update the information contained herein as of any future date.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Except where otherwise indicated, the information contained in this communication is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision.