In our previous updates, we’ve focused on the changes to bank liabilities over the past year, highlighting declining core deposits and rising wholesale funding. In this week’s update, we look at the asset side of the balance sheet.

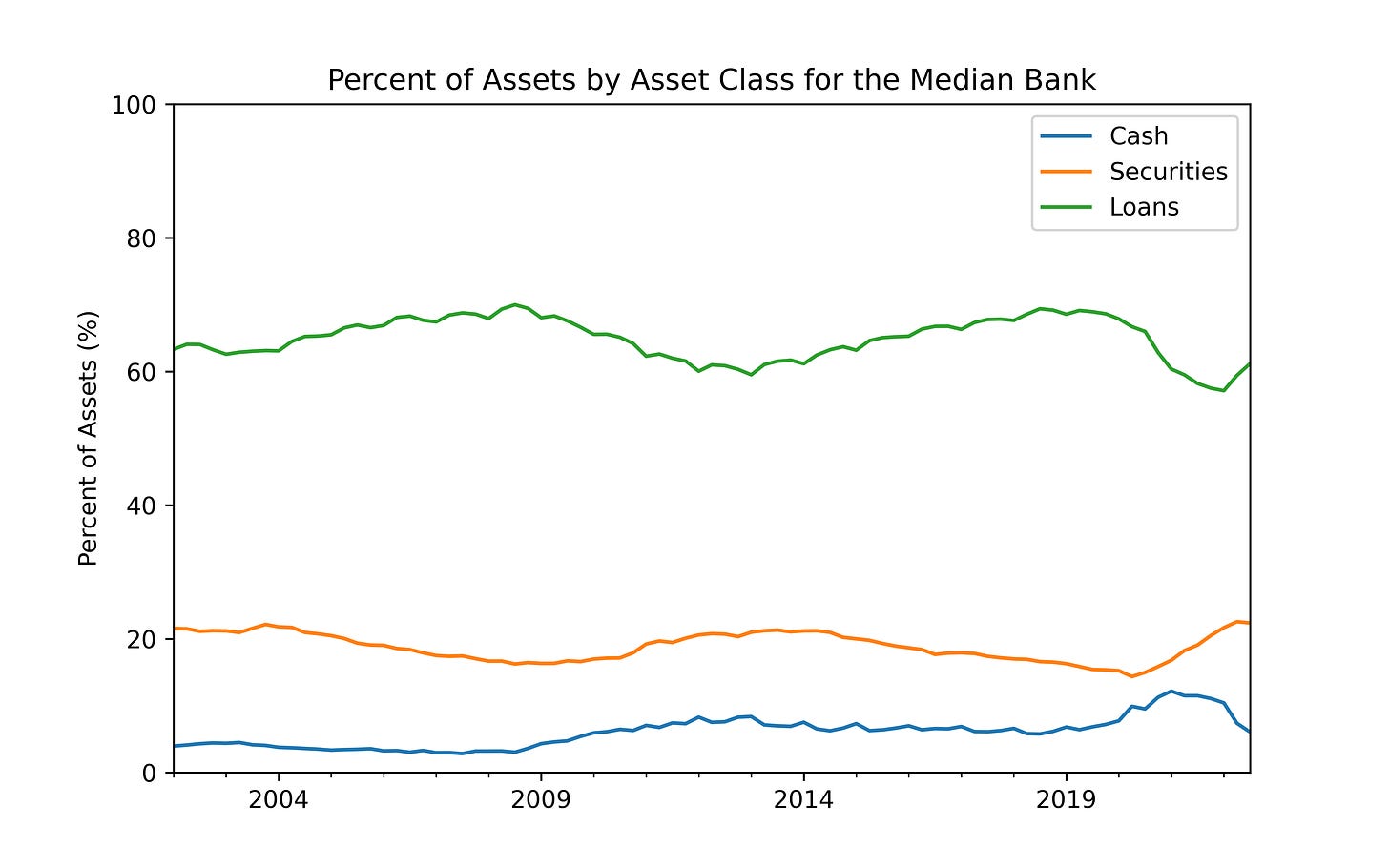

Cash, securities, and loans make up the majority of a bank’s assets. Over the past 20 years, the three asset classes have accounted for 90% of a bank’s balance sheet on average [1]. For the typical bank, the breakdown is normally straightforward; loans make up ~63% of assets, enough cash is held to cover liquidity requirements, and securities are used to boost income whilst maintaining liquidity (see figure below).

Banks saw a huge inflow of deposits during the pandemic, increasing their cash allocations to their highest level on record. At its peak at the end of Q1 2021, cash made up 12% of assets for the median bank. Since then, cash allocations have fallen by half, and, at the end of Q3 2022, the median bank now holds only 6% of assets in cash.

Securities as a percent of assets are now at their highest level on record, as rising interest rates have made the yields on treasurys, money market instruments, and MBSs attractive. As of Q3 2022, securities make up 22% of assets for the median bank, up from 16% in Q1 2021. Loans as a percent of assets fell during the pandemic as cash allocations peaked but are recovering as the allocation to cash declines.

Moving forward, we expect cash levels to stabilize at pre-pandemic levels. It will be interesting to watch the securities vs loans allocation as rates continue to rise and recession fears remain.

Best,

Paolo and the ModernFi Team

[1] The remaining 10% is made up of a variety of items like reverse repos, trading assets, real estate, and goodwill.

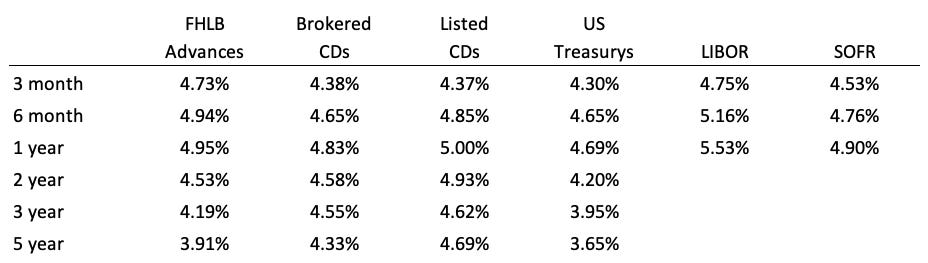

Current rates

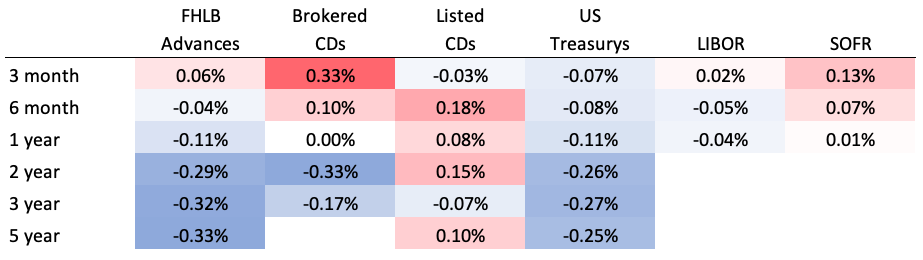

Change from two weeks ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.

Figure is constructed using quarterly data from the FDIC’s BankFind Suite API. Fields used include CHBAL for cash and balances due, SC for securities, LNLSNET for net loans and leases, and ASSET for total assets.

Disclosures:

All information contained herein is for informational purposes and should not be construed as investment advice. It does not constitute an offer, solicitation or recommendation to purchase any security, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Past performance does not guarantee future results. The information contained herein is for institutional use only.

ModernFi Advisers LLC (ModernFi) is not a bank, nor does it offer bank deposits and its services are not guaranteed or insured by the FDIC; ModernFi allocates funds to banks that are FDIC members. ModernFi is an investment adviser registered with the United States Securities and Exchange Commission (SEC). For more information regarding the firm, please see its Form ADV on file with the SEC through the Investment Adviser Public Disclosure website. Registration with the SEC does not imply a particular level of skill or training.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by ModernFi. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by ModernFi or any other person. While such sources are believed to be reliable, ModernFi does not assume any responsibility for the accuracy or completeness of such information. ModernFi does not undertake any obligation to update the information contained herein as of any future date.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Except where otherwise indicated, the information contained in this communication is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision.