During the pandemic, the total amount of deposits in the banking sector grew substantially. Total deposits grew 26% from $15.8T in Q1 2020 to a peak of $20.0T in Q1 2022, leaving the majority of banks with excess deposits – more deposits than loan demand. Now that total deposit levels are declining, the balance may swing the other way, and we may find ourselves in a situation where the majority of banks are in serious need of funding.

Taking a look at historical data, we find the balance between banks with excess deposits and banks that need funding has varied over time. Defining which banks have excess deposits is tricky because it depends on unrecorded loan demand, but a simple heuristic is to compute the fraction of banks where loans account for less than two-thirds of their assets. Many of these banks would prefer to make more loans if they had the opportunity. The figure below displays the fraction of banks with excess deposits since 2000. In Q1 2022, coming out of the pandemic, 71% of banks had excess deposits. As of Q2, many banks are still flush with deposits, but the trend is going the other way.

If the trend continues, the fraction of banks with excess deposits will fall below 50%, and the majority of banks will instead be in need of funding. The fraction of banks with excess has fallen to ~40% on two occasions over the past 22 years. However, if the historical data is any guide, the banking sector will likely remain somewhat balanced between banks with excess deposits and banks that need funding.

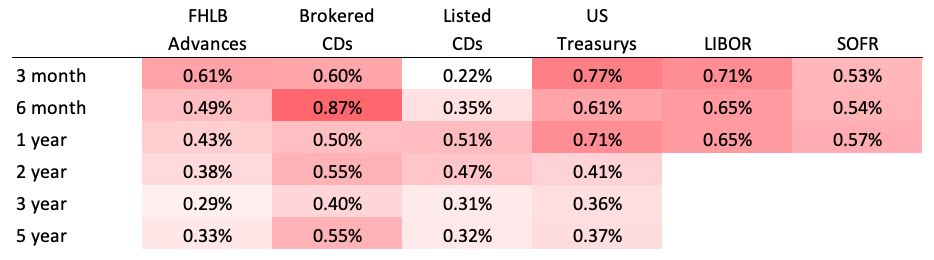

Current rates

Change from four weeks ago

Sources: Deposit data in paragraph 1 and the figure provided by the FDIC. FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.

Disclosures:

All information contained herein is for informational purposes and should not be construed as investment advice. It does not constitute an offer, solicitation or recommendation to purchase any security, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Past performance does not guarantee future results. The information contained herein is for institutional use only.

ModernFi Advisers LLC (ModernFi) is not a bank, nor does it offer bank deposits and its services are not guaranteed or insured by the FDIC; ModernFi allocates funds to banks that are FDIC members. ModernFi is an investment adviser registered with the United States Securities and Exchange Commission (SEC). For more information regarding the firm, please see its Form ADV on file with the SEC through the Investment Adviser Public Disclosure website. Registration with the SEC does not imply a particular level of skill or training.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by ModernFi. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by ModernFi or any other person. While such sources are believed to be reliable, ModernFi does not assume any responsibility for the accuracy or completeness of such information. ModernFi does not undertake any obligation to update the information contained herein as of any future date.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Except where otherwise indicated, the information contained in this communication is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision.