Much attention has been given to deposit outflows over the last year, and deposit growth and retention remain a top priority for banks and credit unions across the country. In fact, deposit growth remains the top priority for most. According to a recent survey by Jack Henry, more than half of banks believe deposit growth is their top strategic priority for the next two years. To power growth, folks are deploying a range of options, including revised and more aggressive deposit pricing, targeted outreach to key clients, and new deposit products. Reciprocal deposits, which help banks attract and retain key clients by providing additional deposit insurance through program banks, have been a critical product for deposit growth over the past year, and we expect their usage to increase.

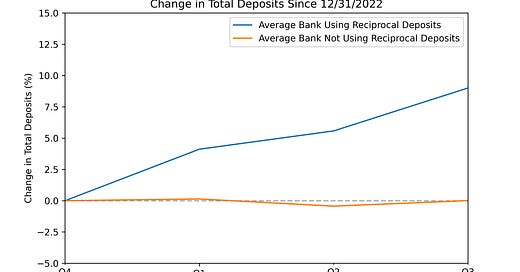

Starting in Q1 2023, many institutions began leveraging reciprocal deposits more actively following the banking stress. By Q3 2023, 41% of all banks, 1867 institutions in total, were utilizing over $330bn in reciprocal deposits. While reciprocal deposits are sometimes viewed as a defensive product, they have proven to be a strong driver of deposit growth. Comparing banks that actively utilize reciprocal deposits to those that do not makes this clear. Through the first three quarters of 2023, the average bank utilizing reciprocal deposits grew 9% faster than the average bank that did not (~12% annualized).

While we can’t attribute the entirety of this difference to reciprocal deposit usage, the numbers highlight that reciprocal products have become critical for deposit growth and retention. Importantly, they offer a non-rate value proposition; instead of paying up on high-yield accounts, a bank can keep rates manageable while offering access to extended deposit insurance through a network instead. We’ll dig in to rate data in a future edition, but for now, it’s clear that reciprocal products can serve as a key lever to increase wallet share with current customers and bring in deposits from new high-value relationships.

Best,

The ModernFi Team

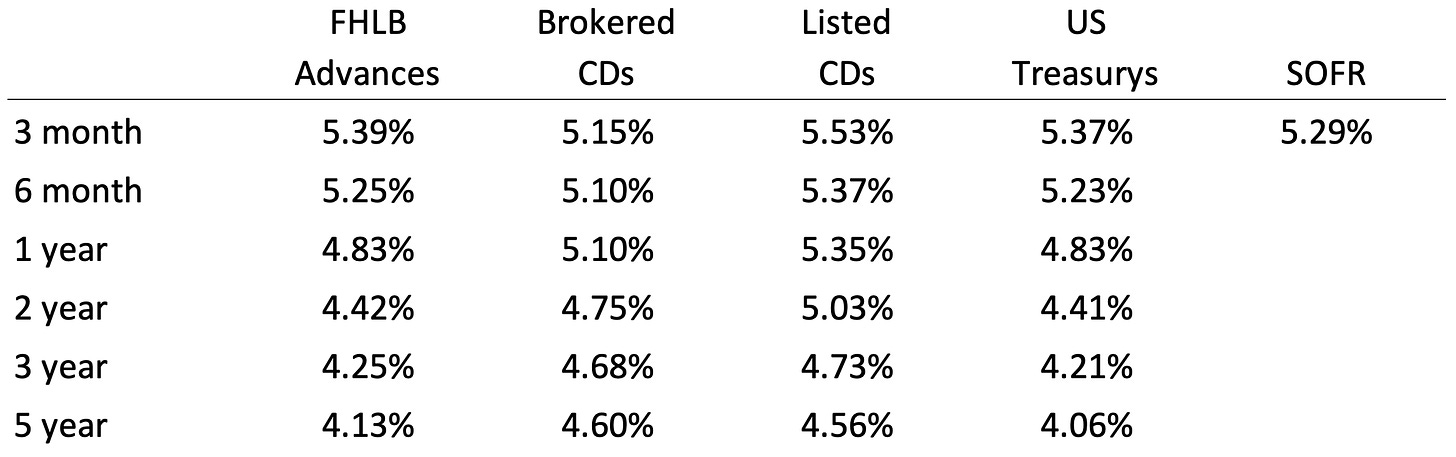

Current rates

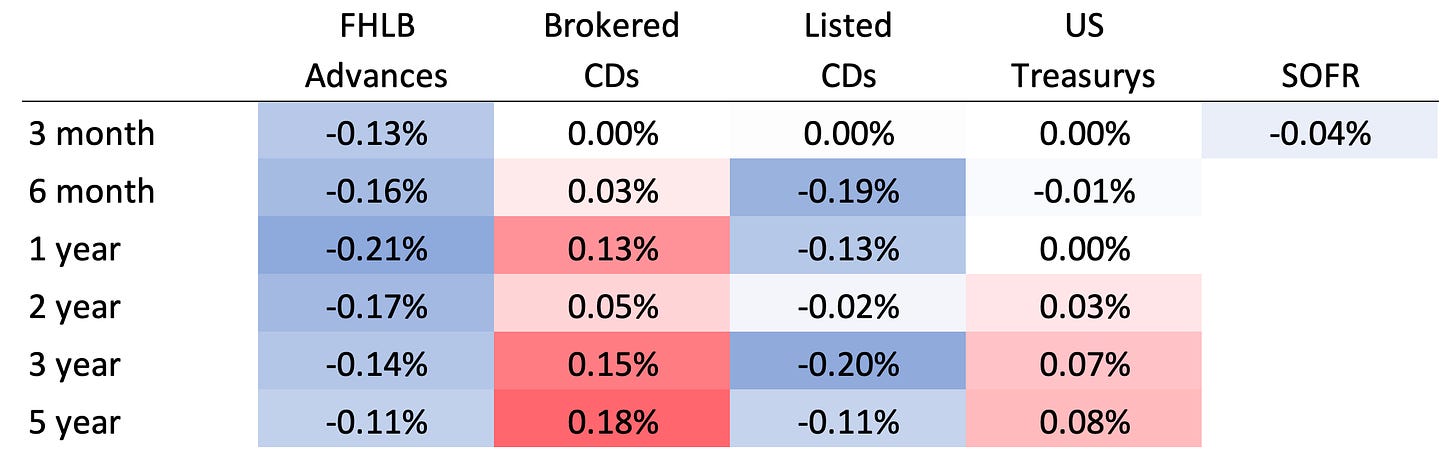

Change from four weeks ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys provided by WSJ. SOFR provided by Chatham Financial.

Deposit data aggregated by ModernFi from FFIEC Call Reports as of 9/30/23.