Liquidity at a Premium Despite Historically High Deposit Levels

January 24, 2023 | Wholesale Funding Update

Astute readers of this newsletter may have noticed a seeming contradiction in our last post; banks are searching for liquidity as deposits decline, yet overall deposit levels remain significantly higher than they were before the pandemic. So what’s the explanation?

Much of the cash generated by rising deposit levels has already been lent out and used to purchase securities. For the average bank, deposits increased by a remarkable 41% from Q4 2019 to Q3 2022. Banks moved to increase lending, and loan balances increased by 20% over the same period. Much of the leftover cash was used to purchase securities, and security balances rose by 86%. Now that deposit levels are falling, banks cannot easily generate liquidity from their loan portfolios, and many are hesitant to sell their securities at a steep loss since the market has turned.

With larger non-liquid asset portfolios, banks simply need more cash on book. Indeed, in the Fed’s most recent survey of senior financial officers, the majority of banks stated that their lowest comfortable level of reserves (LCLOR) has increased by more than 20% since the end of 2019. As we mentioned last time, access to liquidity will be key for institutions this cycle. According to the Fed survey, “When asked which actions their bank would take to increase reserves if their bank’s reserve balances were expected to fall and remain below its LCLOR, respondents most commonly reported that they would borrow in unsecured funding markets, raise brokered deposits or brokered Certificate of Deposits (CDs), borrow in secured funding markets, and increase wholesale deposits by offering higher rates. A large majority of respondents from domestic banks also cited borrowing advances from Federal Home Loan Banks (FHLBs) as very likely or likely.”

Despite historically high deposit levels, liquidity will be at a premium for the foreseeable future.

Best,

Paolo and the ModernFi Team

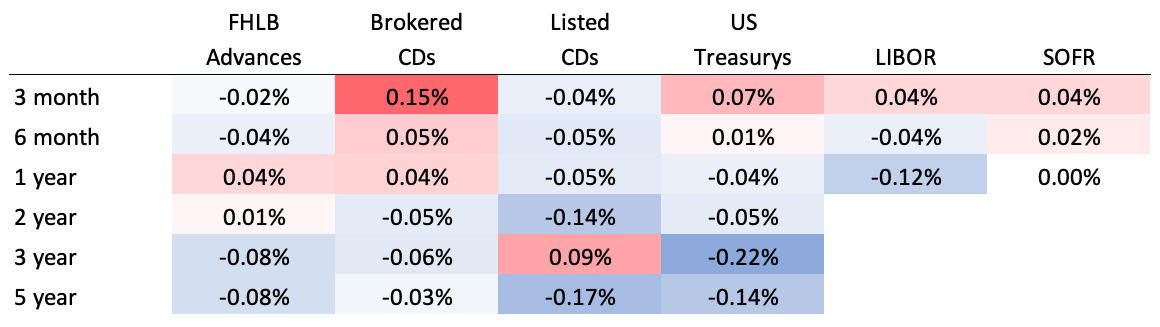

Current rates

Change from two weeks ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.

Data on deposits, cash, securities, and loans is sourced from the FDIC’s BankFind Suite API. Average bank refers to the median bank; as of Q3 2022, 4813 depository institutions were reporting data to the FDIC.