As the ModernFi team supports and scales the first deposit network for credit unions to help grow deposits and member relationships, we wanted to share an analysis of the deposit pressures faced by many in the sector.

Anecdotally, many credit unions have seen wonderful growth over the past few years, in terms of assets, members, deposits and shares. However, those same institutions have been tapping ModernFi to help alleviate deposit pressures. Taking a deeper look at the data, it is easy to see why.

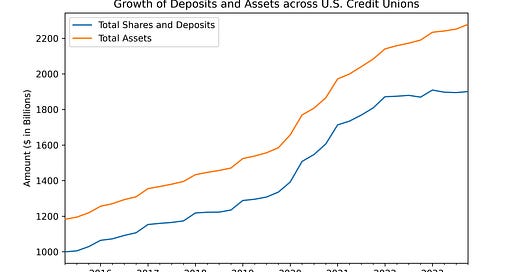

Over the past 8 years since 2015, assets at U.S. credit unions have nearly doubled from $1.2 trillion to $2.3 trillion. Over the same period, shares and deposits have also grown well from $1.0 trillion to $1.9 trillion. While assets and shares + deposits grew in lockstep during the earlier part of the period, their growth has diverged since the start of 2022.

Since the start of 2022, assets have grown by $195 billion while shares and deposits have only grown by $91 billion. This divergence has applied meaningful pressure to many institutions in the industry, who have been forced to turn to alternative funding sources, distracting from their core mission of raising funds from and supporting members.

Over the same period, institutions that have utilized deposit networks like ModernFi have grown deposits 12% faster. Through ModernFi, credit unions are able to provide accounts with extended deposit insurance to attract and retain large-value members, such as businesses, non-profits, higher-net-worth individuals, and public funds. Crucially, ModernFi has been able to help power organic and cost-effective share and deposit growth, supporting credit unions’ missions while alleviating funding pressure.

Best,

The ModernFi Team

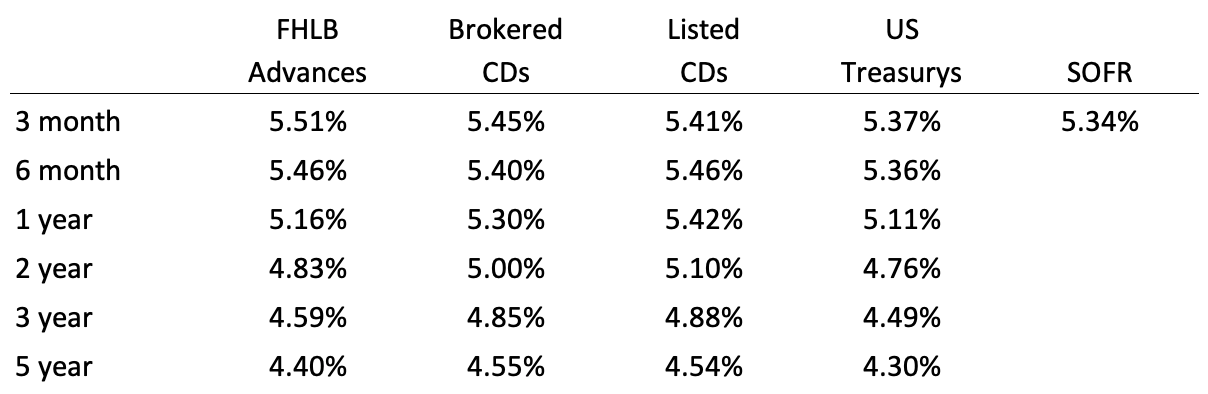

Current rates

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs provided by Fidelity. Listed CDs provided by National CD Rateline. US Treasurys provided by WSJ. SOFR provided by Chatham Financial.

Credit union data provided by the NCUA.

Disclosures:

The market, service, or other information is provided solely for your information and “AS IS” and “AS AVAILABLE”, without any representation or warranty as to accuracy, adequacy, completeness, timeliness, or fitness for particular purpose. The user bears full responsibility for all use of such information. ModernFi may provide updates as further information becomes publicly available but will not be responsible for doing so. The terms, conditions, and descriptions that appear are subject to change; provided, however, ModernFi has no responsibility for updating or correcting any information provided in this communication. No member of the ModernFi organization shall have any liability to any person receiving this communication for the quality, accuracy, timeliness, or availability of any information contained in this communication or for any person’s use of or reliance on any of the information, including any loss to such person.

All information contained herein is for informational purposes and should not be construed as investment advice. It does not constitute an offer, solicitation, or recommendation to purchase any security, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. The information contained herein is for institutional use only.

Neither ModernFi Advisers LLC (ModernFi) nor any of its affiliates are a bank, nor do they offer bank deposits and their services are not guaranteed or insured by the FDIC or NCUA. ModernFi’s deposit network is not a member of the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Administration (NCUA), but the banks where money is deposited are FDIC members and the credit unions where money is deposited are NCUA members. The maximum FDIC or NCUA insurance per Tax ID at each institution is $250,000. If customers have additional deposits at any depository institution that is in ModernFi’s network, then they may not receive full FDIC or NCUA-insurance coverage on the deposits at those institutions. The FDIC is an independent agency of the U.S. government that protects the funds depositors place in FDIC-insured institutions. The NCUA is an independent agency of the U.S. government that protects the funds depositors place in NCUA-insured institutions. FDIC and NCUA deposit insurance is backed by the full faith and credit of the U.S. government.

Any rates shown are hypothetical only and current rates / maximum deposit insurance coverage are subject to change at any time due to changes in market or business conditions. Past performance does not guarantee future results.

All trademarks, logos and brand names are the property of their respective owners. All company, product, and service names used in this website are for identification purposes only. Use of these names, trademarks, and brands does not imply endorsement.

Unauthorized use of the provided information or misuse of any information is strictly prohibited.

ModernFi's deposit network is offered by ModernFi Advisers LLC, a wholly-owned subsidiary of ModernFi, Inc.

© 2024 ModernFi, Inc. All rights reserved.