2023 was a transformative year for banking. Continued rate hikes from the Fed, coupled with the banking stress in March, led to a dramatic change in funding composition across U.S. banks. Core deposits ran off from the system looking for yield and stability elsewhere, and institutions turned to wholesale funding markets to replace runoff and smooth lending. Moving into this new year, we expect these trends to stabilize and moderate, but we expect to see continued heavy usage of wholesale funds and increased competition for core deposits, especially for the largest-value depositors.

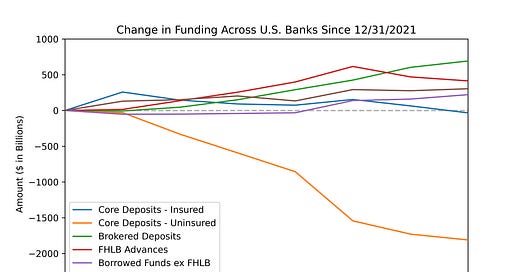

Examining changes in aggregate funding over the past two years makes these trends clear. Since the start of 2022, uninsured core deposits ran off extremely quickly, falling by $1.8 tn, as large-value depositors left looking for higher yields (prompted by rising rates) and security (prompted by the banking turmoil). The runoff in uninsured core deposits was so large that it countered growth in other funding sources, leading to total deposits falling by $1.2 tn across the industry. Insured core deposits remained flat; in more normal periods, we would expect to see consistent ~5% annual growth there.

On the wholesale side, we saw significant growth in brokered deposits, growing by $693 bn over the 2-year period. FHLB usage also increased by roughly the same amount before falling slightly. We assume that, starting in Q1 2023, some FHLB Advances were replaced with Bank Term Funding Program (BTFP) funds, leading to the slight decline in FHLB and the rise in Borrowed Funds, which includes BTFP.

Looking ahead, we expect these trends to continue, albeit less aggressively. The Fed raised rates by 4.25% in 2022 and 1.00% in 2023. Over 2024, despite opinions from pundits and press, we expect the Fed to remain conservative and keep rates steady for as long as possible. We would only expect rates to be cut if the economy significantly declines. (Our funding expectations for 2023 were more or less correct, which has overinflated our self-confidence when it comes to predicting unpredictable things.)

As institutions move into this new year, we recommend focusing on the largest-value depositors to stem runoff, and continuing to keep wholesale funding lines open to smooth the edges. All in all, we’re hopeful for a good year with less stress and a healthy return to banking normalcy.

Best,

The ModernFi Team

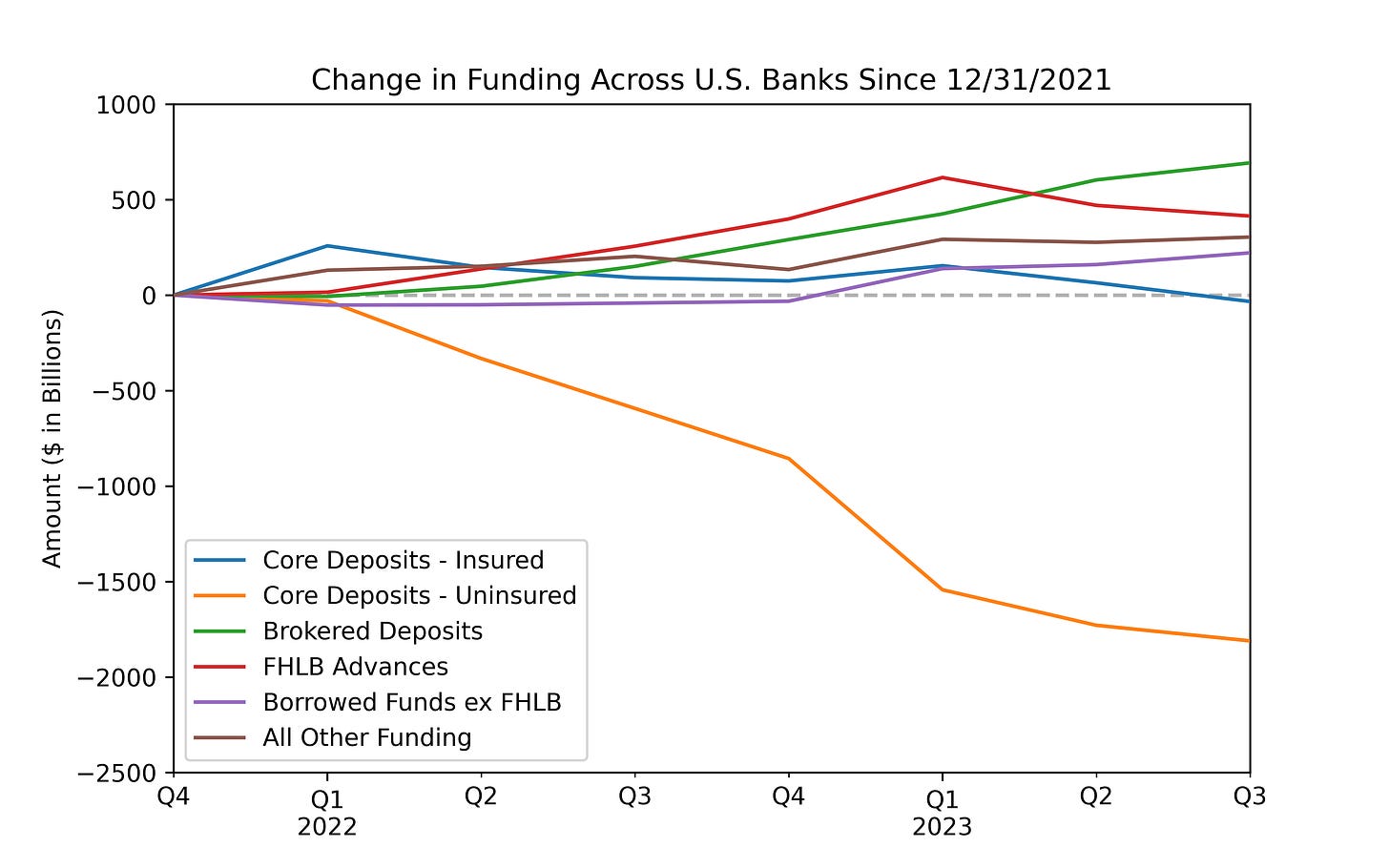

Current rates

Change from five weeks ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys provided by WSJ. SOFR provided by Chatham Financial.

Funding data aggregated by ModernFi from FFIEC Call Reports as of 9/30/23.