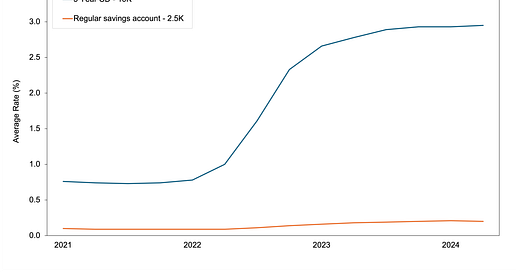

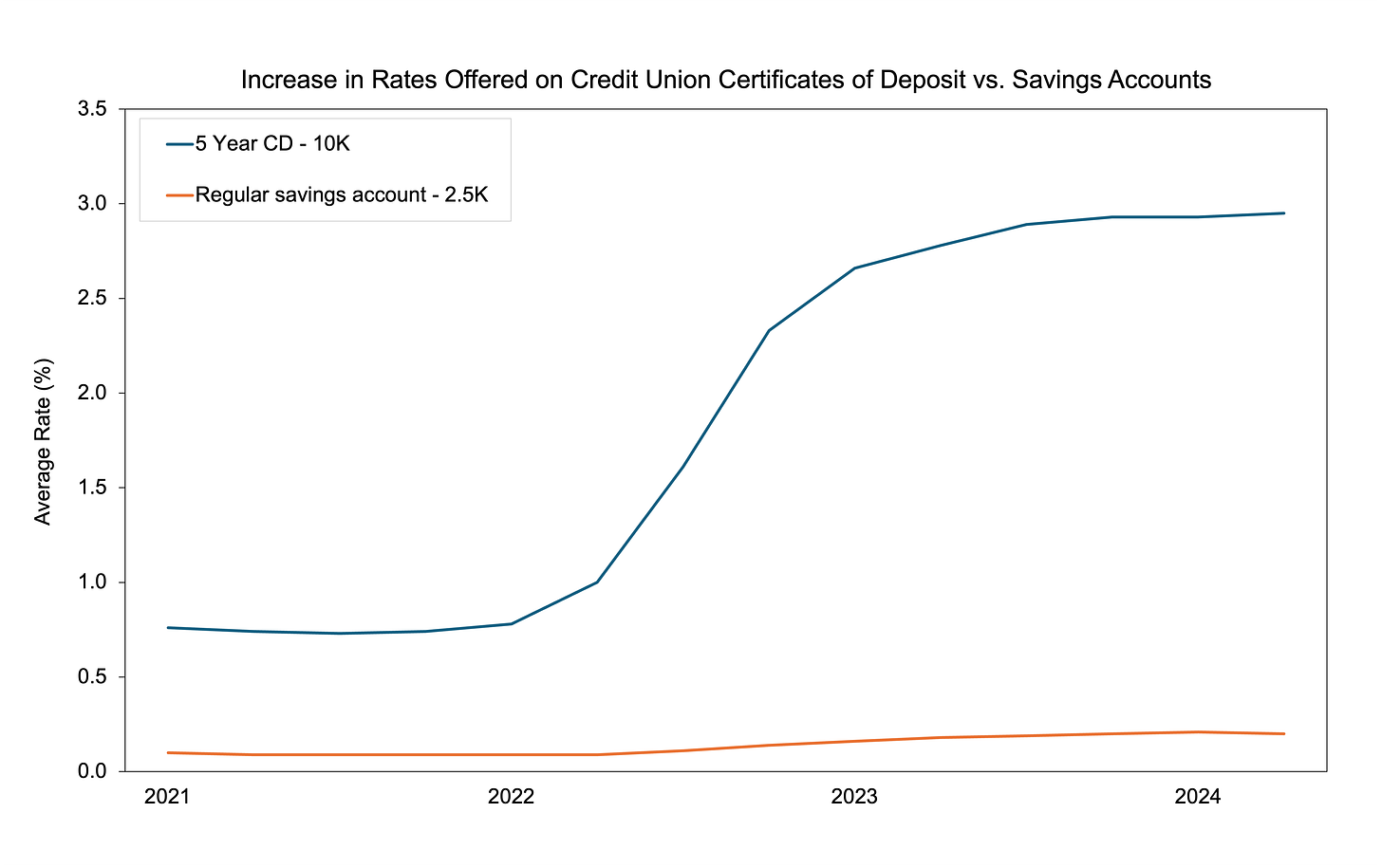

As financial institutions face one of the most competitive deposit environments in recent memory, credit unions are looking for new products and growth avenues to attract deposits and long-term member relationships. Current deposit growth initiatives are largely focused on rate competition, as demonstrated by the sharp rise of CD specials and high-yielding accounts. Over the past year, total regular on-demand shares, where rates did not increase by much on average, declined by 10.6%, while high-yielding share certificates accounts, where rates increased by 2.50% on average, surged by 43.0%.

While rate is an effective lever to attract deposits, it does not always result in the long-term funding and member relationships that a credit union truly desires. Instead, most institutions would prefer to rely on enhancing customer experience, leveraging technology, and building strong relationships to grow deposits, which result in stickier funding and lower interest expense.

To that end, credit unions are leveraging ModernFi CUSO’s deposit network to grow deposits and member relationships, especially with large-value members. Through the ModernFi network, credit unions can offer accounts with extended NCUA insurance* to attract and retain large members without relying on rate. Armed with these accounts, credit unions can now compete for high-net-worth individuals, businesses, municipalities, and others. For many large individual and institutional depositors, such as public funds, extended insurance is a must-have. Not only do these accounts power strong deposit growth in the short term, but they also create long-lasting, sticky relationships; indeed, extended insurance accounts have shown over 100% retention on average since 2018.

As participants join the ModernFi network, we’ve seen many leverage accounts with extended insurance to grow deposits without high rates. Most set interest rates for their insured sweep accounts below the rate of their money market accounts, as the main draw for members is the insurance, not the yield.

As the credit union industry continues to evolve, extended insurance accounts represent a forward-thinking approach to deposit growth. By focusing on security rather than rates alone, credit unions can build lasting relationships with their most valuable members.

Best,

The ModernFi CUSO Team

* NCUA insurance provided by program credit unions (subject to meeting certain conditions)

Sources: Credit union data provided by NCUA Call Reports. Retention data from S&P Global.

Disclosures:

The market, service, or other information is provided solely for your information and “AS IS” and “AS AVAILABLE”, without any representation or warranty as to accuracy, adequacy, completeness, timeliness, or fitness for particular purpose. The user bears full responsibility for all use of such information. ModernFi may provide updates as further information becomes publicly available but will not be responsible for doing so. The terms, conditions, and descriptions that appear are subject to change; provided, however, ModernFi has no responsibility for updating or correcting any information provided in this communication. No member of the ModernFi organization shall have any liability to any person receiving this communication for the quality, accuracy, timeliness, or availability of any information contained in this communication or for any person’s use of or reliance on any of the information, including any loss to such person.

All information contained herein is for informational purposes and should not be construed as investment advice. It does not constitute an offer, solicitation, or recommendation to purchase any security, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. The information contained herein is for institutional use only.

Neither ModernFi Deposit Services LLC, ModernFi CUSO LLC, ModernFi Inc. (collectively ModernFi) nor any of its affiliates are a bank, nor do they offer bank deposits and their services are not guaranteed or insured by the FDIC or NCUA. ModernFi’s deposit network is not a member of the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Administration (NCUA), but the banks where money is deposited are FfDIC members and the credit unions where money is deposited are NCUA members. The maximum FDIC or NCUA insurance per Tax ID at each institution is $250,000. If customers have additional deposits at any depository institution that is in ModernFi’s network, then they may not receive full FDIC or NCUA-insurance coverage on the deposits at those institutions. The FDIC is an independent agency of the U.S. government that protects the funds depositors place in FDIC-insured institutions. The NCUA is an independent agency of the U.S. government that protects the funds depositors place in NCUA-insured institutions. FDIC and NCUA deposit insurance is backed by the full faith and credit of the U.S. government.

Any rates shown are hypothetical only and current rates / maximum deposit insurance coverage are subject to change at any time due to changes in market or business conditions. Past performance does not guarantee future results.

All trademarks, logos and brand names are the property of their respective owners. All company, product, and service names used in this website are for identification purposes only. Use of these names, trademarks, and brands does not imply endorsement.

Unauthorized use of the provided information or misuse of any information is strictly prohibited.

ModernFi's deposit network is offered by ModernFi Deposit Services LLC, a wholly-owned subsidiary of ModernFi, Inc.

© 2024 ModernFi, Inc. All rights reserved.