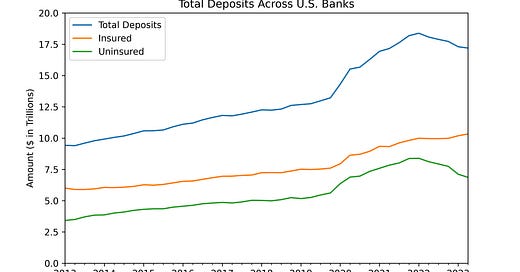

We’ve spoken at length about the large amount of deposit runoff that banks have faced since the Fed started raising interest rates in Q1 2022. Since then, $1.2 trillion, roughly 7% of the total deposit base, has left the banking sector. To contextualize just how unusual this is: 2022 was the first full-year decline in total deposits since the FDIC started releasing data in 1992. Many institutions have simply never seen this before.

Digging in deeper reveals something unexpected, but perhaps not completely surprising. The deposit runoff has been completely driven by uninsured deposits. Between Q1 2022 and Q2 2023, $1.5 trillion uninsured deposits flowed out of the sector while $337 billion insured deposits flowed in. Faced with the most aggressive deposit runoff in history, banks have actually seen deposit growth in aggregate for their insured funding.

Large-value depositors, those with more than $250,000 in funds, left the banking sector looking for higher-yielding alternatives and, post the banking turmoil, safety and stability, driving the uninsured outflows. However, banks continue to see healthy growth in insured deposits, which provide the safety that is so central to an institution’s value proposition. While uninsured outflows are likely to continue, insured deposits, and products like sweep / reciprocal accounts that can provide extended insurance to large-value depositors, can continue to drive deposit growth during this unfamiliar period.

Best,

The ModernFi Team

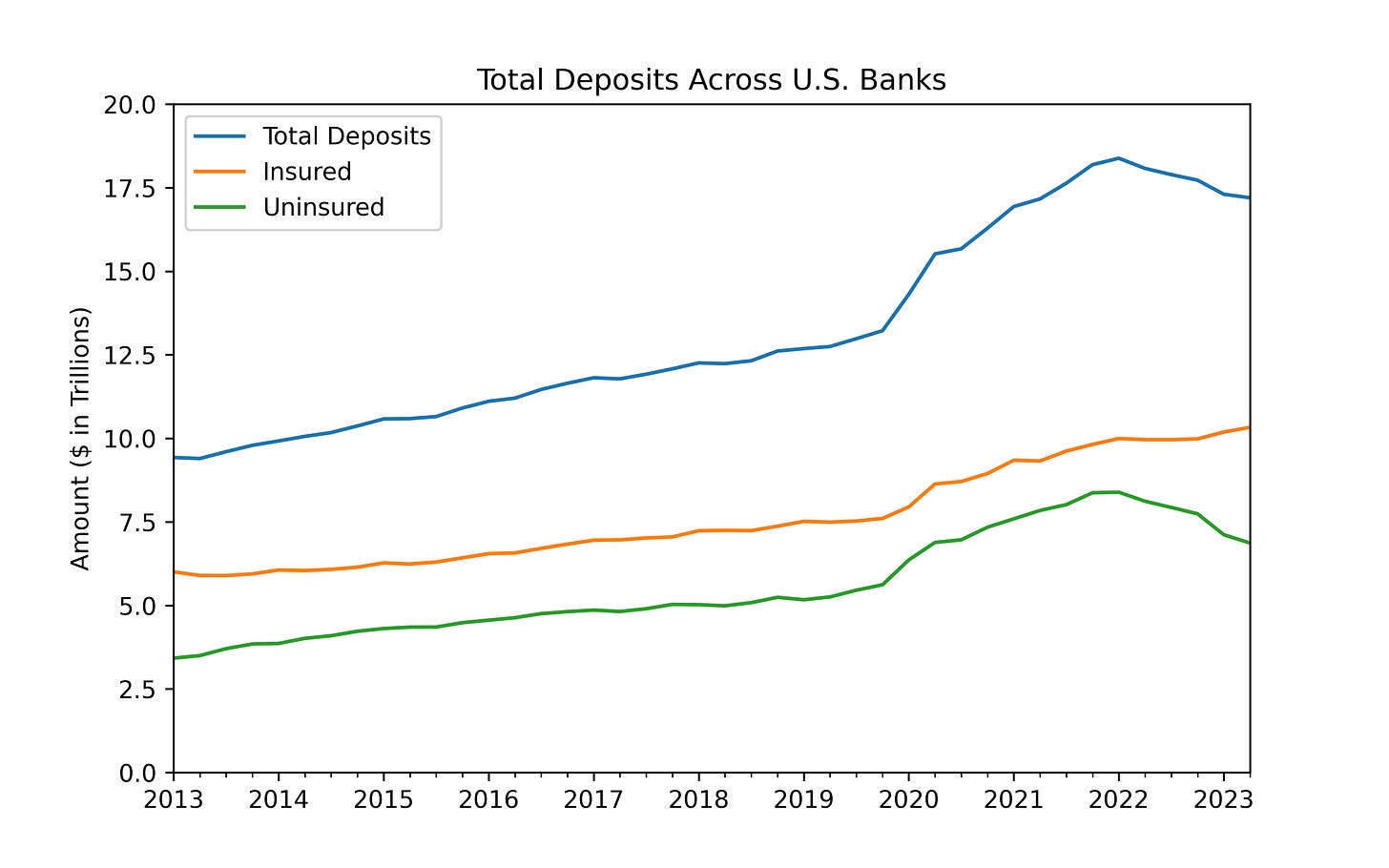

Current rates

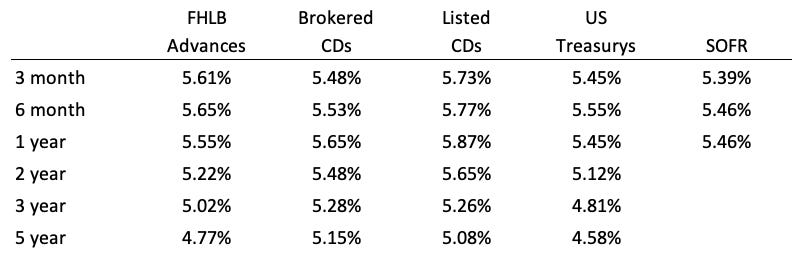

Change from two weeks ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys provided by WSJ. SOFR provided by CME. Deposit data provided by the FFIEC Call Reports.

Disclosures:

All information contained herein is for informational purposes and should not be construed as investment advice. It does not constitute an offer, solicitation or recommendation to purchase any security, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Past performance does not guarantee future results. The information contained herein is for institutional use only.

ModernFi Advisers LLC (ModernFi) is not a bank, nor does it offer bank deposits and its services are not guaranteed or insured by the FDIC; ModernFi allocates funds to banks that are FDIC members.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by ModernFi. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by ModernFi or any other person. While such sources are believed to be reliable, ModernFi does not assume any responsibility for the accuracy or completeness of such information. ModernFi does not undertake any obligation to update the information contained herein as of any future date.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Except where otherwise indicated, the information contained in this communication is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision.