Competition for deposits among banks continues to rise on the heels of another Fed hike. In response, banks are raising rates on deposit accounts to retain their current depositors and entice new funds. To quickly bring in new funds, many institutions are launching high-yield products (both savings accounts and CDs), and, as a result, deposit cannibalization is once again top of mind for funding teams.

Deposit cannibalization occurs when existing depositors move funds from older, lower-yielding products to their bank’s newer, higher-yielding offerings. The result is a lose-lose for the bank; their cost of funds goes up without bringing in any new money. Many banks will impose a “new money” condition on high-yield products to limit the impact of cannibalization (such as “To open an account, you must deposit at least $30,000 of new money to the bank.”) Despite new money limitations, anywhere from 40-60% of funds in new offerings tend to come from old accounts, undermining the impact of rate specials.

One of the beautiful and not-often-discussed benefits of wholesale funding is that it does not cause deposit cannibalization. Depositors do not see the rate that banks pay for wholesale funds, and they have no way of moving their funds to earn the wholesale rate. In fact, even though wholesale rates are normally higher than retail rates, the lack of deposit cannibalization can often result in a lower total cost of funding for banks (see the example below).

Wholesale funding’s lack of deposit cannibalization makes it an even more powerful tool in this rising rate environment.

Best,

Paolo and the ModernFi Team

Appendix: Cost of funds example with deposit cannibalization

Consider a bank paying 1% on $100mm deposits. The bank would like to raise an additional $100mm and can do so by 1) offering a high-yield savings account at 4%, or 2) purchasing wholesale funding at 5%.

Under option 1), the bank raises the additional $100mm at 4%, but some deposit cannibalization also occurs as existing depositors move funds from the 1% yielding account to the higher yielding option. Assuming 40% cannibalization, the bank is now paying 1% on $60mm and 4% on $140mm, resulting in an average cost of funds of 3.1%.

Under option 2), the bank raises the additional $100mm at 5%. With no cannibalization, the bank is now paying 1% on $100mm and 5% on $100mm, resulting in an average cost of funds of 3%.

I’m no rocket scientist but 3.1% > 3.0%.

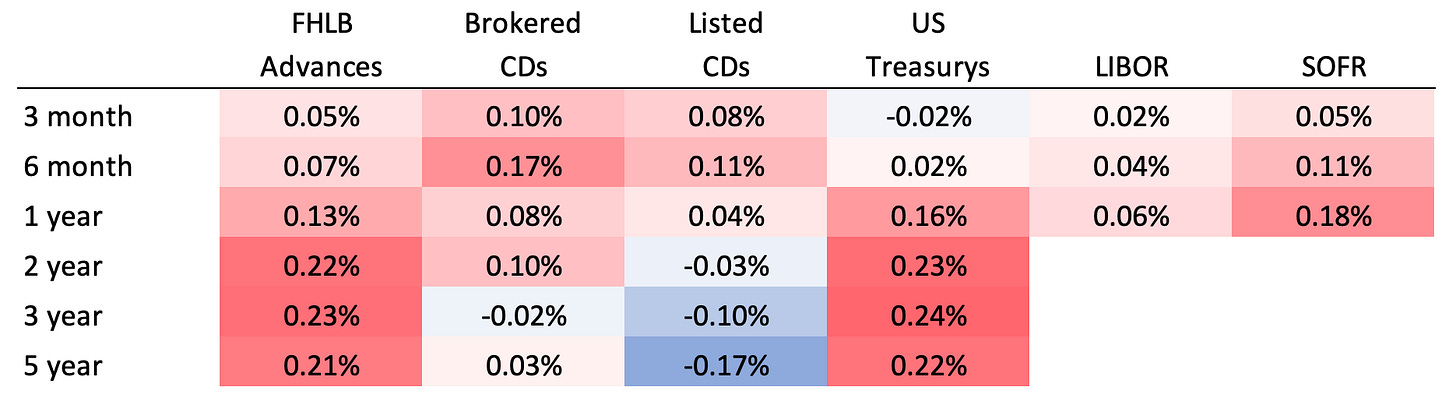

Current rates

Change from two weeks ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.

Data on deposit cannibalization comes from a recent Darling Consulting Group (DCG) webinar titled “The Deposit Difference” from January 18, 2023. DCG is an expert in the space and has a wealth of deposit data. See more here.