In previous updates, we’ve highlighted the impact of rising rates on liquidity in the banking sector. The Fed’s most aggressive tightening cycle in the past four decades, combined with quantitative tightening, has drained deposits from the system. As a result, competition among banks for deposits is increasing, which has led to sharp rise in core deposit rates.

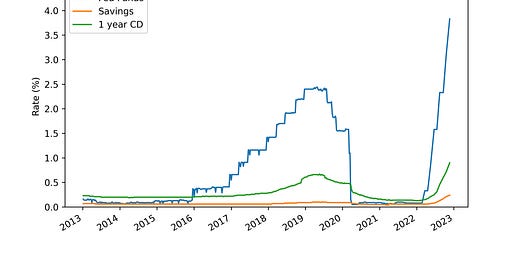

Historically, core deposit rates rise slowly when market rates rise because banks benefit from sticky deposit bases and prefer to earn the spread. During the 2015-2018 rate hike cycle, the effective federal funds rate (EFFR) increased from 0.12% to 2.40%, while the national average savings rate barely changed from 0.06% to 0.09% (see figure below), giving the industry a deposit beta of 1.3%.

This time around, however, increased competition and demand for deposits has forced more banks to compete on rate. In the current 2022 rate hike cycle, the EFFR has increased from 0.08% to 3.83%, and the national average savings rate has already increased from 0.06% to 0.24%, a 4x increase within one year, resulting in an industry deposit beta of 4.8% so far.

Further rate hikes, continued draining of deposits, and increased competition for funding will likely push core deposit rates higher in 2023. While increased funding costs will cut into bank net interest margins, institutions will also benefit from increased interest income from their securities and loans portfolios.

Best,

Paolo and the ModernFi Team

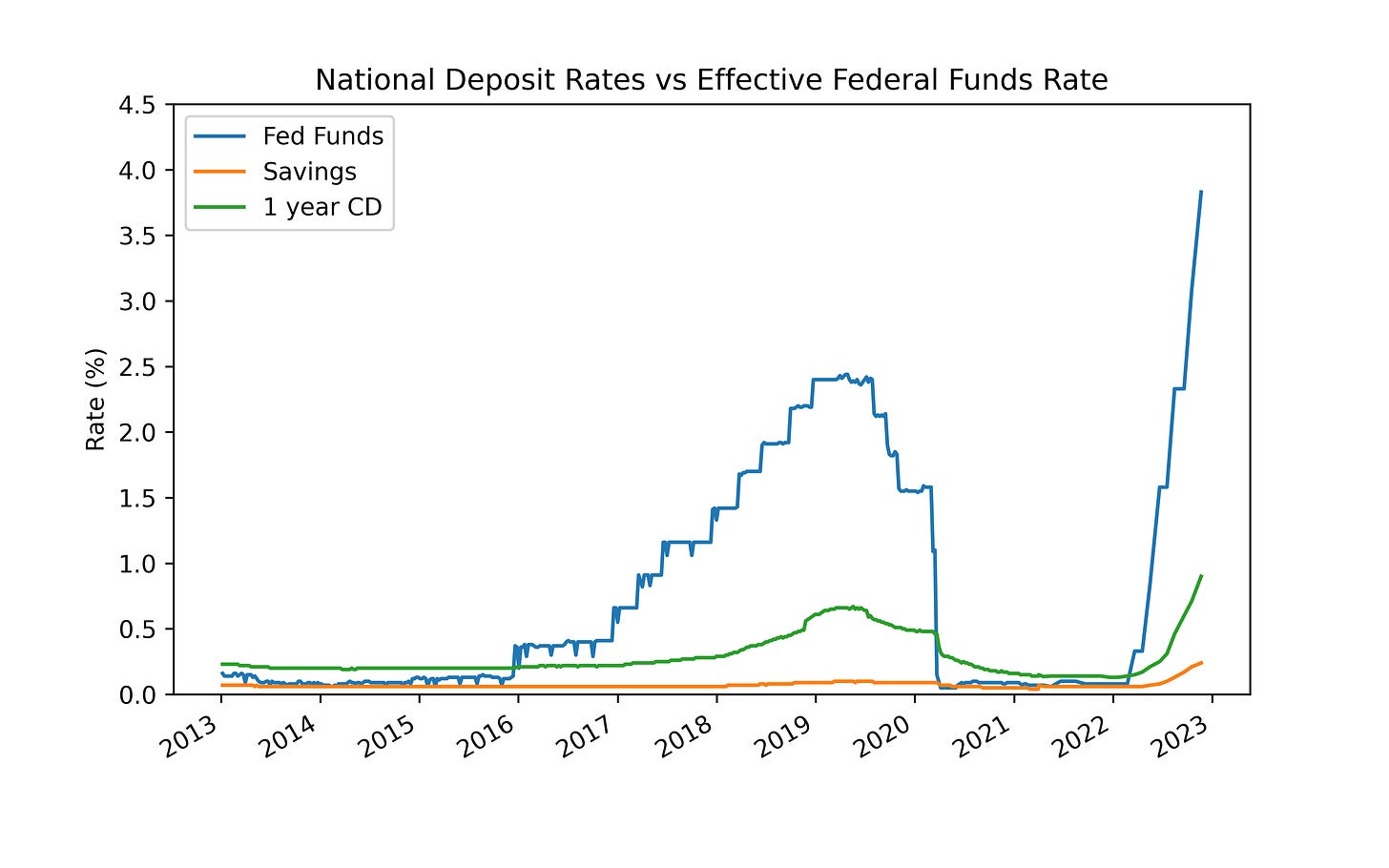

Current rates

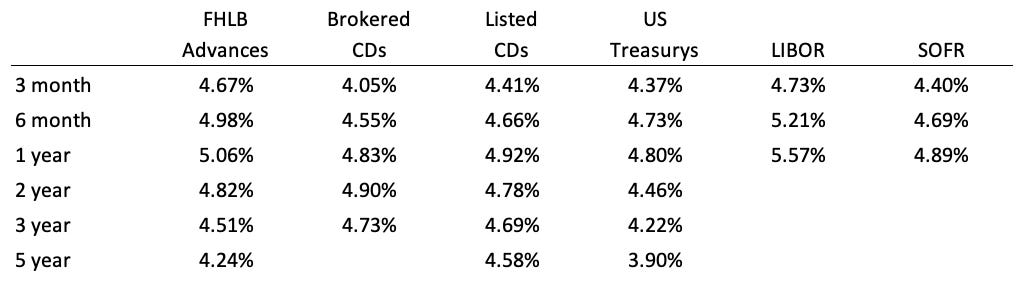

Change from two weeks ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.

Figure is constructed using weekly data from the FDIC’s National Rates and Rate Caps database and the St. Louis Fed’s FRED interest rates database. National deposit rates are the average of rates paid by all insured depository institutions and credit unions for which data is available, with rates weighted by each institution’s share of domestic deposits.

Disclosures:

All information contained herein is for informational purposes and should not be construed as investment advice. It does not constitute an offer, solicitation or recommendation to purchase any security, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Past performance does not guarantee future results. The information contained herein is for institutional use only.

ModernFi Advisers LLC (ModernFi) is not a bank, nor does it offer bank deposits and its services are not guaranteed or insured by the FDIC; ModernFi allocates funds to banks that are FDIC members. ModernFi is an investment adviser registered with the United States Securities and Exchange Commission (SEC). For more information regarding the firm, please see its Form ADV on file with the SEC through the Investment Adviser Public Disclosure website. Registration with the SEC does not imply a particular level of skill or training.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by ModernFi. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by ModernFi or any other person. While such sources are believed to be reliable, ModernFi does not assume any responsibility for the accuracy or completeness of such information. ModernFi does not undertake any obligation to update the information contained herein as of any future date.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Except where otherwise indicated, the information contained in this communication is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision.