The banking sector has been in the news more than usual these days. Rising interest rates, compounded with the recent high-profile bank failures, have led to the most aggressive deposit runoff from the sector in history. Combined with jitters around the health of commercial real estate loans and the prospect of increased regulatory burdens, pundits and commentators concerned with the future of the sector are starting to predict a large amount of bank consolidation, as smaller institutions merge or are acquired by their larger peers. While consolidation is not always a negative, the diversity and number of U.S. banks is an extremely valuable feature of the American economy.

The U.S. is unique in its prevalence of community and regional banks. America’s 4672 institutions is by far the most of any country. Russia, in second place, has roughly 400. Over history, the role and independence of smaller banks have been protected by both regulation and by the communities they serve, and for good reason. These institutions truly form the foundation of the American economy, providing an outsized amount of credit. Banks smaller than the top 25 account for ~40% of all lending in the country — 28% of commercial and industrial loans, 37% of residential real estate loans, 67% of commercial real estate loans, and 48% of all other consumer lending, according to Fed data. If credit is the lifeblood of progressive economies, then community and regional banks form the heart and arteries.

Aggregate numbers aside, the diversity and targeted size of community and regional banks provide a meaningful advantage. These banks focus and specialize in their particular geographic regions, demographics, or industries. We have banks that specialize in agriculture, small businesses, merchants, lawyers, fintechs, among others. Without the presence of community banks, larger institutions often end up overlooking and underserving entire areas and sectors of the country, leading to what the Fed calls banking deserts.

So while some consolidation is highly likely as institutions consider economies of scale, we hope, and are confident that, the diversity and range of the American banking sector — and the outsized role of community and regional banks — will continue to thrive.

Best,

Paolo and the ModernFi Team

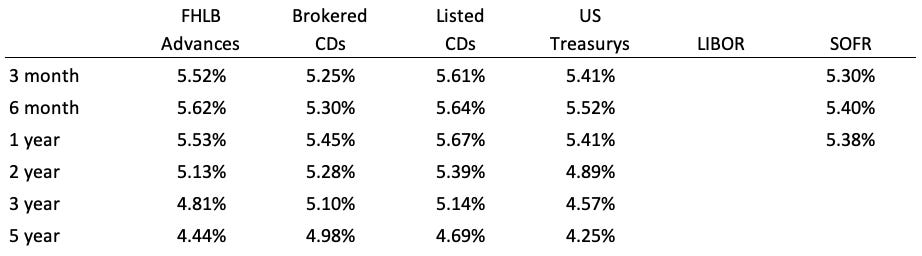

Current rates

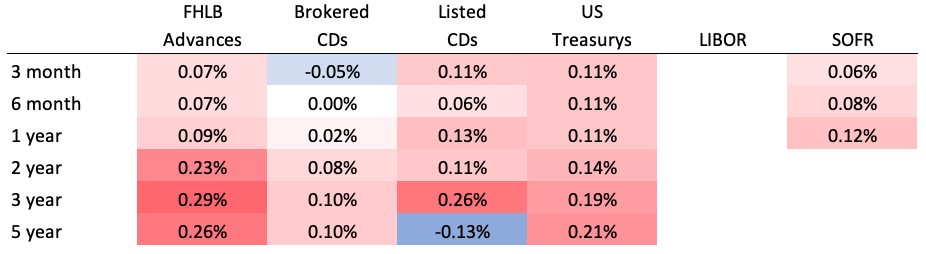

Change from two week ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys provided by WSJ. SOFR provided by CME. RIP LIBOR, which has ceased publication as of June 30, 2023.