In our previous newsletter, we briefly touched on how banks use alternative funding sources such as FHLB Advances to fill liquidity gaps. FHLB Advances are a powerful tool for ALCOs that provide both immediacy and transparency. Through an Advance, banks have same-day access to funds for immediate cash needs and can easily understand the cost and term of such funding. Advances, however, are a secured loan and may require additional collateral to be pledged if borrowing needs exceed the blanket lien.

Pledging additional collateral produces two strains on a bank: 1) the requirement to process collateral, and 2) a performance drag on a bank’s asset portfolio. A bank typically needs a team and processes in place to ensure that it is meeting FHLB’s collateral eligibility requirements and concentration limits. In addition, collateral haircuts — the amount at which FHLB values the collateral — make lower-return asset classes such as U.S. government or agency securities more favorable to pledge as collateral. As result, there is an opportunity cost, or “collateral drag”, of potential return on assets as Advances limit a bank from allocating funds to higher-performing asset classes.

In contrast, sourcing funding through deposits does not require collateral and does not produce collateral drag on a bank’s portfolio. Traditional means of sourcing deposits such as physical branches, digital banking, and deposit brokers do not provide the same level of immediacy and transparency as FHLB, limiting a bank’s ability to precisely fill liquidity gaps. Deposit networks, however, have the infrastructure to act in a similar capacity as FHLB, but traditional networks tend to transact via phone, email, and blind auctions. ModernFi has introduced a new deposit network model using modern technology and efficient operations to bring same-day or next-day deposit funding to banks. In the words of one of our partners, ModernFi’s solution acts like the “FHLB for deposits”.

While solutions like ModernFi increase funding efficiency for banks, an institution should never rely on one funding source. As we have learned time and time again, including from SVB, banks should have a diversity of funding sources on tap – a mixture of deposits from different customer types and in different deposit products, Advances, and ModernFi.

Best,

Adam and the ModernFi Team

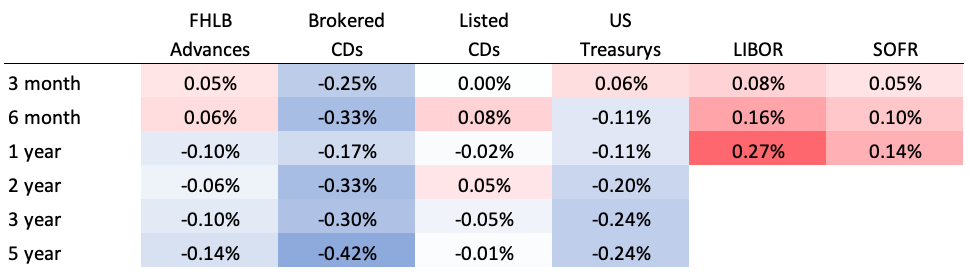

Current rates

Change from one week ago

Sources: FHLB Advances are an average of FHLB Boston, FHLB Chicago, and FHLB Des Moines. Brokered CDs are an average of Fidelity and Vanguard. Listed CDs provided by National CD Rateline. US Treasurys and LIBOR provided by WSJ. SOFR provided by CME.